Onboarding project | SmartQ

We had worked on our ICPs in Acquisition project, i will be going deeper into ICPs by gathering insights on our service need, why they choose our company, what makes us unique, etc

ICP table for SmartQ

Criteria | ICP1 | ICP2 | ICP 3 |

|---|---|---|---|

Name | Mid sized organization, International presence | Growing Startup | Mid sized organanization |

Company Size | 500-1500 | 500-1000 | 1000-1500 |

Location | Bangalore | Bangalore | Bangalore |

Industry Domain | Fintech | HRTech | Pharma |

Funding Raised | Yes | Yes, Series A to F | Yes |

Stage of the company | Matured Scale | Early Scale | Matured Scale |

Growth of company | Moderately growing | High growth | Moderately growing |

GMV | 4-8cr | 2cr | 4-6cr |

Preferred Outreach Channels | Cold Call, Face-to-Face meetings, Email, Reference | Cold Call, Face-to-Face meetings, Email, Reference | Online meetings, Email, Reference |

Organisational Goals towards cafeteria | Give best F&B experience - good food, Employee experience without budget constraint | Provide food not just to satisfy hunger but to make people recharged for the day | Need a vendor who can cater consistently to 1500 people. employee's health is key |

Motivation | Get best employees through benefits of company - Cafeteria, salary, gym, etc | Transform food experience to make them feel energized and talk about the service to others | Employee retension and health is the motivation |

Priorities | Exceptional service - Employee experience | Basic service, consistency and reliability | No nonsense, less noise from cafeteria, Tech should be an enabler, needs Transformation - Change |

Challenges | Inconsistent food service, no reliable food partner, Difficulty to find & maintain highly audited vendor | no reliable food partner, Vendor who passionately produces food, Menu repetition | Multiple people to discuss on same problem, Inconsistent food service from vendor |

Decision Maker | Admin Head | Admin Manager | Admin director |

Behaviour traits of the decision maker | Objective driven, Impact, benefit driven | Need social proof, transparency, team whom he can depend on | No nonsense, crisp communicator, needs detailed planning |

Blocker | Procurement Manager | Procurement team | Finance Team |

Influencer | Food committee | Food committee, CXOs | CXOs |

Budget for service | Doesn't care about budget but experience is important | Should be competitive in the market but occasional increase in price for specific value add is good | Price sensitive and highly volatile |

Conversion Time | 3-4months | 2-3months | 3-4months |

General info: Services used other than SmartQ | Housekeeping, Workplace management products, Global HRMS tool, Routematic, Slack, Microsoft Office, Routematic | Slack, Google suite, IT conferencing solutions, Airmeet, Housekeeping, IT solutions, Own HR Tool | Slack, Microsoft Office, HRMS, CRM, Smarten spaces, Housekeeping |

General info: Time spent at workplace | in meetings, auditing cafe, budget planning, facility management | in meetings, expansion planning, budget planning, additional responsibilities from HR team | in meetings, Surpise audits of vendor, budget planning, facility management |

General info: Features/ services they value | Reports, Employee surveys, Feedbacks, Mentions on Glassdoor/ internal portal | Reports, Feedbacks, Partner reliability | Food service, tech for giving subsidy, Reports,

Feedbacks, healthy food |

SmartQ: Frequency of use case | Daily once | Daily twice | Daily thrice |

SmartQ: Features/ services they value | Consistent food service, Reports, Employee surveys, Feedbacks, Audits, Compliance documents, pop up counters, Activities to enhance employee experience | Reliable and Consistent food service, MBR,

Feedbacks, Audits, Compliance documents, pop up counters | Consistent food service, Reports, Employee surveys, Feedbacks, Audits, Compliance documents |

SmartQ: Where do they spend time | Daily 10 mins time spent with ops team to daily summary Monthly spends 30 mins with Ops leader for MBR | Daily 5 mins time spent with ops team to daily summary Monthly spends 60-90 mins with Ops leader for MBR | Monthly spends 30 mins with Ops leader for MBR Daily whatsapp summary review |

SmartQ: Where do they spend money | Core food service, Decor during festivals, Special days when Expats visit office | Core food service,

Special days when Expats visit office, Annual day, Hackathon food | Core food service only |

After doing the research calls, here are few things which got more clear:

1. SmartQ is valued because of its depth of service for our Ideal customers. If customers wants just transactional service like just one thing - food service (Buffet) and nothing other than main food service then the proposition doesn't hold strong as food is highly commoditized and whoever gives best rate they will get the deal and SmartQ's actual value is not realized

- Appetite to pay: Companies usually who are transactional are also found to have less appetite to pay, this category can be depriotized from the beginning so that effort goes in right accounts.

ICP Prioritization

After

Criteria | Adoption Rate | Appetite to Pay | Frequency of Use Case | Distribution Potential | TAM ( users/currency) |

ICP 1 ✅ | High | Very High ✅ | Low | Very High ✅ | 1600+ clients |

ICP 2 ✅ | Very High ✅ | Medium | High ✅ | High | 1200+ clients |

ICP 3 | Medium | Low | Very High | Medium | 500+ clients |

This ICP prioritization is similar to our 1st project prioritization, we can further focus on ICP2 and ICP1 for further onboarding. Among the 2, ICP 2 is prioritized as there is very high adoption rate and frequency of usage of our product. Apart from this, the scope of service drastically increases from core food service to event/ occasion based food service which could be a great win in terms of the business.

Goal Priority | Goal Type | ICP | JTBD | Validation approach | Validation |

Primary | Functional | Both ICPs | Get me the best food vendor who can consistently provide good food service | User interviews, Operations team review | "I want to provide great food for my employees always without falling short in quality over time" |

Secondary | Social | Both ICPs | Win appreciation and recognition from my employees for providing good cafeteria experience with food | User interviews, Sales team review | "I want to win respect and grow in my role by giving what is best from my employees in the cafeteria." |

In our case both ICPs goals exactly match. As both ICP admins are trying to get food vendor who is reliable, consistent and experience oriented.

When i was checking for other Customer Profiles in our Industry, i found some interesting insights.

1. If a person is focusing on financial goal for the organization then falls short in providing great experience for the employee as they would get transactional to just core food service which might not a great area to compete for SmartQ.

2. If a person starts looking at personal goal, we have often see admins asking what is in it for me which makes them take a path of demanding money indirectly. This is against our principles of integrity, so that is not a good customer profile to target

- There are 3rd category of people where they are impressing management, employees through services rendered by SmartQ. They intend to do it to grow in their role (promotion, etc). Even though it is personal benefit, there is a strong social angle to it. Hence we are considering this as secondary goal for both ICPs

SmartQ Sales and Launch funnel

2 big stages of Onboarding for SmartQ is Sales funnel and Launch funnel. We see Sales taking 2+months and Launch funnel is usually 1 month. But once we enter the launch funnel we have had 98% retention of the client for atleast 6months. As we are in food business and SmartQ focuses a lot in depth of food and allied services we have been able to have a great retention score.

Sales Funnel 🤝

SmartQ has a big sales journey which usually takes 2month for any prospect to convert. Here is a quick view for the sales funnel

What is working well? 👏

SmartQ's in depth understanding of food business and principles of doing right thing for Vendor, client and customers has always been an edge. Once the client gets a taste of this, they end up becoming our ambassadors. Here are the list of things which is working well for us:

- Face to Face meeting (Was a part of a meeting)

This is working in our favour because we do not go ahead with a presentation to show in the meeting rather hear our Client's pain points completely. This consultative approach of understanding what is going wrong and exactly focusing on that pain point through our solution has worked well.

Here are few highlights from the meeting:

a. Sales team asked client to walk us through the cafe and tell their pain points. This gave an immersive understanding

b. For the problems they had, Sales team gave example of how we have solved in other cafeterias which gave the client some confidence

c. Assured them for a trial experience in those cafeterias which was not expected by the client - Scoping and Free Site Audit

The detailed scoping document is used to discuss with the client to understand if all the pain points were covered. Here most of the clients get aligned with what we do and get trust over our process.

- Free Site Audit 🤩 - The Aha moment for client

I am not able to share the image or the site audit report here due to confidentiality. But i will be sharing the list of things included in the Audit report below.

Aha Moment for client through Free Site audit report

Why this makes difference?

Admin usually rely on vendor for food and external auditors for food audit reports but it is usually transactional - either for a food incident situation or a annual audit. But SmartQ's comprehensive audit is one of its kind where not only vendor is analysed but cafeteria and 13+ channels are thoroughly analysed and reported with a score. This becomes SmartQ's starting point and we take it from there to increase the score for a greater number.

What is not working well? Why ? 🚨

In SmartQ Sales funnel journey we see major drop offs in Awareness stage - 70%+, then In Proposal stage 20% to analyze this i went through following aspects:

- Awareness Emailer (Analysed below)

- Cold call script (Not able to share the file)

- Company profile (Analysed below)

- Proposal (Very bulky presentation, shared below)

Lets look at awareness emailer which is sent right after cold call:

Here is the Company profile - 1 pager. This is shared on Whatsapp, emailer and also handed out to client based on the conversation

Final Proposal - Bulky but can be short if Annexure can be avoided

Here the Gaps were on 3 Aspects which could be done better:

- Information overload and no visual hirarchy of content in Email and few slides of Company profile. Final proposal document was smartly made. If the annexure could be hidden then it will be better as the proposal will be within 16 pages if not it was 53 pages (Admins might not go through important parts seeing 53 page document)

- Jobs to be done for the Ideal customer profile was not coming out in Subject lines and headings. It was a part of the communication but no prioritized well

- No Clear CTA in Emailer. Client might be reading it as the open rate is 32% but not taking action due to no clear call to action, focus on core value proposition.

Launch Funnel

SmartQ has a one month long launch funnel for any prospect to converted. Here is a quick view for the sales funnel. The launch funnel is the first experience of onboarding for any client, when we spoke to clients most of them were very happy during the launch phase.

What’s Going Well in the SmartQ Launch Funnel? 👏

- Mobilization Stage (Pre-Launch Setup)

- Key processes like site menu engineering, site marketing, and cafeteria facelift are executed smoothly. The client remains involved throughout, ensuring alignment with their expectations.

- This is primarily an offline process that focuses on understanding the client, employees, and site dynamics—and it’s running effectively without major challenges.

- Employee Feedback Collection During Launch

- As soon as the food service starts, employees are actively encouraged to share feedback.

- Multiple feedback channels are provided - Physical feedback, App based feedback and Tablet feedback stations in cafe

- The feedback is collated daily, generating:

- Daily reports shared with vendors.

- Weekly reports shared transparently with clients.

- This structured and closed loop feedback system is well-received by clients and adds to SmartQ’s credibility.

What Could Be Improved? 🚨

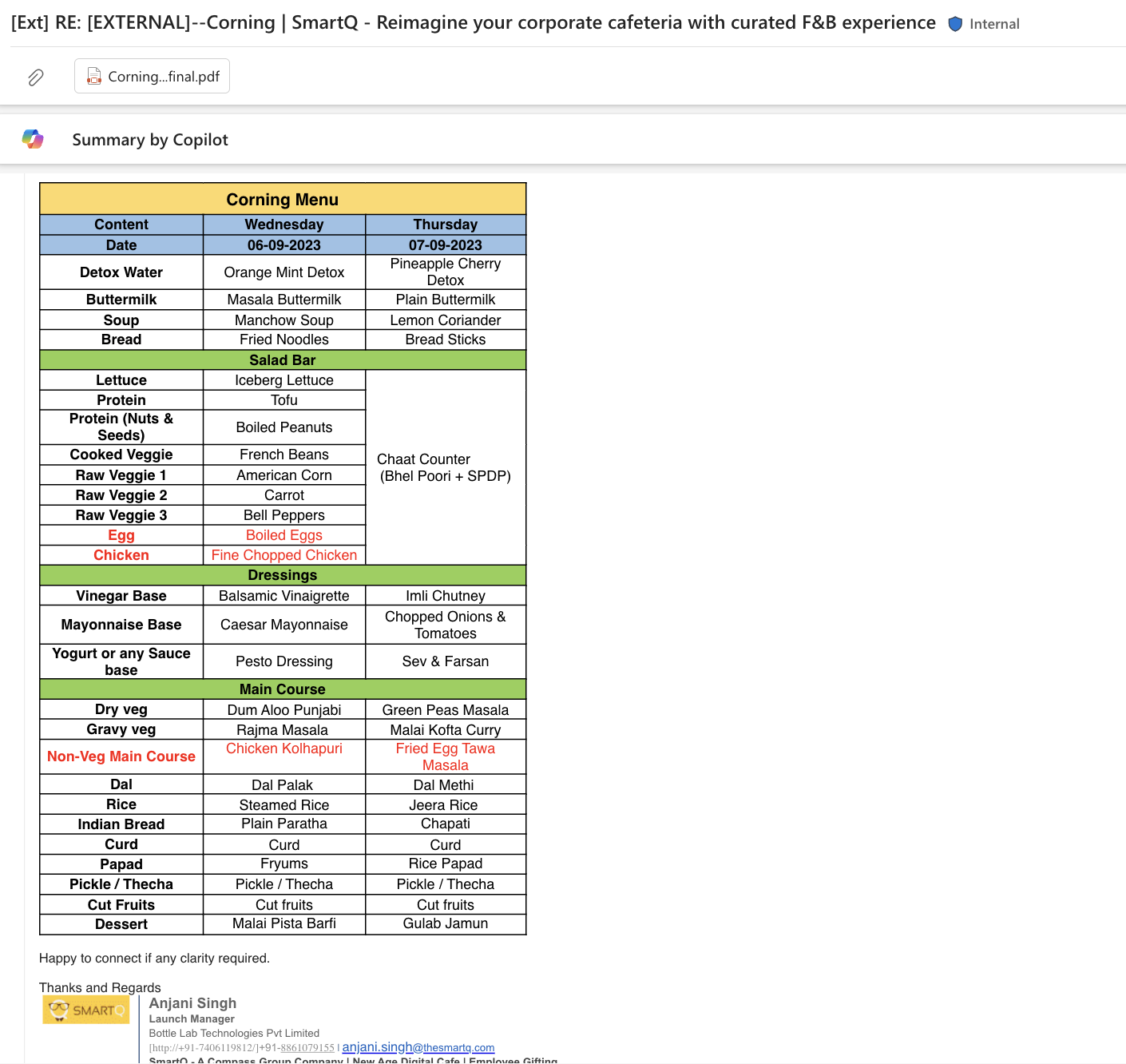

Better Presentation of the Pre-Launch Menu

- Currently, the menu is shared via email in an unstructured format.

- While SmartQ focuses deeply on menu engineering, the presentation doesn’t always reflect that level of detail and effort.

- A visually appealing, well-structured menu format—perhaps an interactive digital layout or a branded template—could enhance the client experience and set the right expectations before launch.

Aha moments 🤩

1️⃣ Sales Funnel – The Site Audit Surprise

- One of the biggest AHA moments happens during the sales process when SmartQ conducts a detailed site audit with 15+ key parameters.

- When the admin receives this comprehensive report, they are often pleasantly surprised because they don’t expect this level of insight from SmartQ.

- This moment is powerful because it sets the stage for a transparent partnership—both SmartQ and the client clearly see the starting point, making future improvements measurable and meaningful.

2️⃣ Launch Funnel – The Unexpected Weekly Feedback Report

- Clients typically expect monthly reviews, but when SmartQ delivers a detailed feedback report at the end of the very first week, it creates another AHA moment.

- This report includes:

- Employee feedback trends

- Adjustments vendors have already made

- A real-time happiness score

- A performance rating (out of 5)

- Seeing such proactive, data-driven insights early on reassures the admin that SmartQ isn’t just a vendor—it’s a partner committed to continuous improvement.

Cognitive bias

We might no be doing any of these things intentionally but when analysed i am able to see some cognitive bias

- Ikea effect: Throughout SmartQ sales and Launch funnel, we are keeping the client engaged about each and every thing. Right from the meeting where client told us pain points, the client starts feeling that they are working with us to form a solution hence there is always attachment towards our solution. This could be called as ikea effect.

- Recency Effect: Instead of waiting for a monthly review, admins get real-time weekly feedback, making them more engaged.

- Priming: Above we can see before every stage we are keeping the client informed about what is about to come as next step. Like in Site scoping, we gave a affirmation to client that we are going to use these data points to track our progress further.

I am creating activation metric from Sales funnel stage itself as launch stage and later has 100% activation already due to the type of business we are in.

Hypothesis 1: Prospect completing 1 SmartQ's live site visit within 30 days of first meeting

Reason: We’ve seen that when a prospect takes a site visit within 30 days, they’re far more likely to move forward. But if they don’t, they often go cold or get distracted by competitors. Seeing SmartQ in action—how the food is served, how employees feel—makes all the difference. A quick follow-up within a week and a little FOMO can help nudge them. When they hear from other admins during the site visit, it just helps to move to the deal stage.

Hypothesis 2: Prospect completing 1 food trail at their cafeteria within 60 days of first meeting

Reason: A prospect who completes his food trial at his/ her cafeteria, has a high chance of moving for agreement sign stage. At this stage, Employees, food committee and CXOs start behaving as our influences which helps us move forward quickly as they have experienced the service. During this stage, Feedback/ food survey taken during the trial plays a critical factor for understanding the performance. Most of SmartQ trails have converted as a client within 10-14 days from trial, so this becomes a very important metric to track

Hypothesis 3: Prospect brainstorming & building 1 new tech feature in SmartQ within 30 days of first meeting

Reason: Food subsidy management is a common challenge for our ICPs. Through our consultative approach, when clients co-create a tech feature with us, it becomes a strong reason to stay. This builds the IKEA Effect—the more involved they are, the more they value and stick with the solution. Some clients have been with us for 7+ years because the tech we built for them feels tailor-made and irreplaceable.

Hypothesis 4: Admin head (Ex client at another company) moves to a new organization does 1 meeting with us within 2months of him joining a new company

Reason: When an ex-client joins a new company, they often become a high-potential prospect. If they reach out for a meeting within 2 months, it’s a strong signal—they’re looking to make an impact within their first quarter. Our existing relationship and past success make SmartQ an easy, trusted solution. These leads tend to convert quickly, as admins want a reliable win in their new role.

Hypothesis 5: Prospect gets a referral/ trust note from 1 known source within 15 days of sales team meeting them.

Reason: The admin community relies on trust and connections. A well-timed referral can instantly spark interest and move a prospect forward. We recently saw this in action—a cold prospect turned warm the moment a friend recommended SmartQ. This proves that referrals at the right time and place can be game-changers in driving engagement and conversions

Hypothesis 6: Prospect getting 1 pop up counter/ food event within 15 days of sales team meeting them

Reason: POPs and events are a great way to get a foot in the door with an account. If we execute even one successful event, admins see the impact firsthand, building trust and confidence in SmartQ. We’ve seen that when an event goes well, the intent to convert increases—making it a powerful entry point for long-term partnerships

Quantitative metrics to track

1. TAT of conversion of lead

- TAT of Cold to 1st meeting

- TAT of 1st meeting to live site visit

- TAT of Site visit to Trial

- TAT of Trial to deal sign

- TAT of 1st meeting to brainstorming 1 tech feature

- Lead quantity/ source (ex: Referral, Direct, Old client, New lead)

- Number of known referrals/ client

- Engagement time in Meeting

- Number of meetings (This shows intent to work with us)

Qualitative metrics to track

- CSAT for Trial

- Feedback review in launch phase

- Client happiness score in 1st month - Monthly business review

- Referral intent after launch

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.